About The Pet Industry

The pet industry allows animal lovers the chance to not only play with dogs but to also work in a field they feel good about—providing positive experiences to all breeds of dogs and their pet parents. Spending your days doing something you have a passion for makes the entire work experience more rewarding, increases personal gratification, and boosts overall happiness. As the old saying goes, “Love what you do, and you’ll never work a day in your life.”

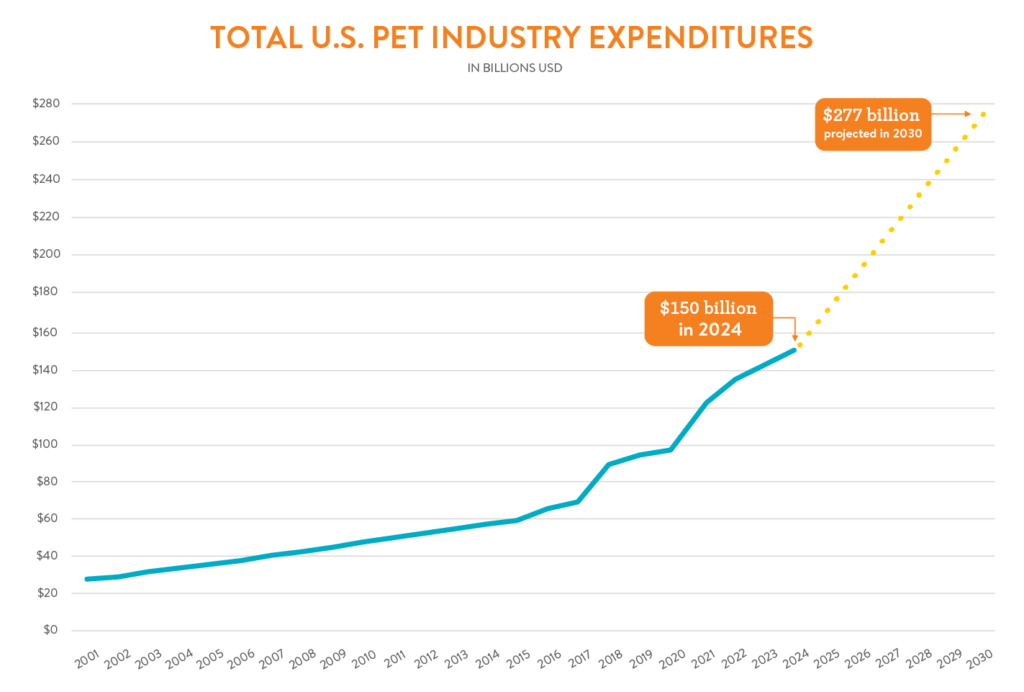

The pet industry’s growth rate is impressive and shows no signs of slowing down. In 2024, $150.6* billion was spent on pets in the U.S., which is up 3% year over year in an industry that has grown steadily since the mid-’90s, says the American Pet Products Association.

PET INDUSTRY’S FAVORABLE OUTLOOK

- Pet industry expenditure projections for 2025: $157B+

- $12.3B of the pet market is fragmented and highly underserved

- 71% of U.S. households own a pet, which equates to 94 million homes, up from 82 million in 2023

- 95% of pet owners view their pets as family members

- Almost 75% of millennials own pets

- 70% of Gen Z pet owners have two or more pets and is the generation leading multi-pet ownership

- Over the past five years, pet care, grooming, and training services have been the fastest-growing segments in the pet services industry

- The global pet market is worth $320 billion and is projected to reach $500 billion by 2030

BUSINESS OPPORTUNITY

The pet industry has become a booming $157B+ industry—and it’s growing fast. Employment in the sector grew by well over 90% from 2005 through 2015. The pet industry grew from $48B in 2010 to $70B in 2017 and spiked to $110B during the pandemic due to increased pet adoption and continues to grow across generations.

“The pet industry is booming,” writes JJ Kinahan, chief strategist at TD Ameritrade, in an email. We spend as much on our pets’ care as we do on our own or on our kids’.

Pets are taking on the role of children for many Americans, says Patrick Watson, senior editor at Mauldin Economics. This is particularly true for millennials, who are delaying marriage and having fewer kids. As pet owners increasingly humanize their pets, “they’re more willing to spend money on things like premium pet care and food products,” Kinahan says. Investors large and small recognize this. In 2021, over $1.22 billion in capital was raised, which made it a substantial year for pet tech in venture capital, according to insights by PitchBook.

“Supply chain issues, inflation, and a looming recession are creating yet another opportunity for the pet space to prove itself invincible. Investors looking for a safe haven during this current market unrest are actively pursuing opportunities in the pet sector. Not a week goes by that I don’t field a call from a PE firm looking to enter or expand in the space.” – Tom Elliott, Managing Director, Capstone Partners

According to the American Pet Products Association, 70% of U.S. households own a pet, which equates to 94 million homes. Growth in this sector, not surprisingly, has coincided with a significant national increase in what Americans spend on their pets. Pet parents are increasingly treating their pets as a member of their family, with 80% reporting they treat their pets like their children, 60% celebrate their pets’ birthdays, and 46% reporting buying clothing or fashion accessories for their pet.

There was an issue displaying the chart. Please edit the chart in the admin area for more details.Because dogs are becoming more of an integral member of a family unit, pet parents want to purchase the best products and services for their pup. This was proven by the 5.7% decrease in value dog food brands and the increase in premium brands by 9% between 2012 and 2015. When it comes to pet services, more pet parents choose luxury options not only to alleviate their busy schedule but also for the benefit to their dog. Due to the increased humanization of pets, the pet service industry alone is expected be worth $500B by 2030.

According to the U.S. Bureau of Labor Statistics, the growing demand for pet care services, including dog trainers, groomers, pet sitters, kennel attendants, and caretakers in shelters and rescue leagues, is expected to continue going forward.

70% of all pet owners in the U.S. own at least one dog. People are more likely to own a dog when they are not raising children, which is why millennials and aging baby boomers are the highest demographic of pet owners. 75% of people within each demographic own a pet and this number continues to rise. This increase is due to the inherent increased aging in baby boomers and the delayed age millennials are beginning to have children.

Furthermore, pet parents are looking for more than just the norm. They are looking for a place to socialize, exercise, and educate their dogs—not just dog walkers and sitters. Dogs are naturally social animals, and as the humanization of the dog continues, pet parents are realizing the need to raise well-behaved and healthy pups through these important facets of pet parenthood, very similar to a child attending school.

DOG DAYCARE SERVICES ARE RECESSION-RESISTANT

According to a national poll, an astounding 71% of pet parents said they spent the same on their pet during the pandemic than they did before. During economic downturns, some industries often feel the pinch, but the pet industry is not one of them. While consumer spending decreased 3% overall during the last recession, spending on pets continued to increase at a 5% annual rate. Many pet parents are more willing to cut costs and eliminate little luxuries elsewhere in their lives before spending less on their beloved furry family members. Despite economic fluctuations, 77% of U.S. pet owners report that financial concerns have not impacted their pet ownership.

Pet owners aren’t going to stop spending on their pets just because money is tight. They don’t view these costs as “discretionary spending” and “are willing to give up other expenses to cater to their pets,” says Jodi Burrows, vice president of SDR Ventures, which has provided advisory and private capital formation services to the pet industry.

“This translates to an industry that will continue to do well even if the economy weakens,” Watson says. The industry isn’t immune to market pullbacks, but downturns will be less severe and shorter lived than for other industries, he says.

NOTE: This website is not a franchise offering. A franchise offering can be made by us only in a state if we are first registered, excluded, exempted, or otherwise qualified to offer franchises in that state and only if we provide you with an appropriate franchise disclosure document. Follow-up or individualized responses to you that involve either effecting or attempting to effect the sale of a franchise will be made only if we are first in compliance with state registration requirements or are covered by an applicable state exclusion or exemption.